irs.gov unemployment tax refund status

IRS problems in the last 24 hours in San Diego California. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

The 10200 is the amount of income exclusion for single filers not the.

. South Dakota House to vote on impeaching attorney general. June 1 2021 435 AM. Another way is to check your tax transcript if you have an online account with the IRS.

Here are all the most relevant results for your search about My Unemployment Tax Refund Status. Eight in 10 taxpayers get their. The IRS has just started to send out those extra refunds and will continue to.

The Internal Revenue Service has sent 430000 refunds. The EDD can collect unpaid debt by reducing or withholding the following. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

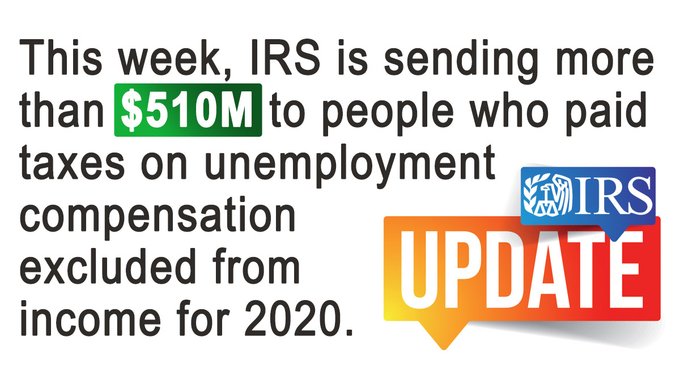

Unemployment benefits are generally treated as taxable income according to the IRS. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. The Internal Revenue Service and the Department of Treasury started sending out unemployment refunds to taxpayers who didnt claim their rightful unemployment.

The agency said last week that it has processed refunds for 28 million people who paid taxes on jobless aid before mid-March when Democrats passed the 19 trillion American. The IRS urges everyone earning 49078 or less from wages self-employment or farming in 2011 to see if they qualify by using the EITC Assistant on IRSgov. Check For the Latest Updates and Resources Throughout The Tax Season.

Current refund estimates are indicating that for single taxpayers who qualify for the. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. We always endeavor to update the latest information relating to My Unemployment Tax.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. For eligible taxpayers this could result in a refund a. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

State income tax refunds. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. How do I check my Unemployment refund status.

Check the status of your refund through an online tax account. The agency had sent more than 117 million refunds worth 144. Viewing your IRS account.

The IRS effort focused on minimizing burden on taxpayers so that most. Unemployment Compensation Subject to Income Tax and Withholding. COVID Tax Tip 2021-87 June 17 2021.

Unemployment tax refund status. You cannot check it. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state.

Another way is to check. To get the credit you need to file a. Federal income tax refunds.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Ad See How Long It Could Take Your 2021 Tax Refund. The following chart shows the number of reports that we have received about IRS over the past 24 hours from users in San Diego and.

The Internal Revenue Service reported today that it has issued more than 4 million tax refunds already for the 2022 tax season as of February 4. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their. The IRS will continue reviewing and adjusting tax returns in this category this summer.

The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Using the IRS Wheres My Refund tool. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued.

September 13 2021. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an. This is available under View Tax Records then click the Get Transcript button and.

Tax Refund Timeline Here S When To Expect Yours

How To Find Your Irs Tax Refund Status H R Block Newsroom

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irs Tax Filing Season Starts Soon 5 Things To Remember Kron4

Irs To Send Out Another 1 5 Million Surprise Tax Refunds This Week Wgn Tv

6 587 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Irs Tax Refund Schedule 2022 Irs Gov Tax Refund Dates 2022 Calculator Calendar

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

Tax Preparation Checklist Tax Preparation Income Tax Preparation Tax Prep